About Us

• Apex Buyout Holdings LLC ("Apex") is a private equity family office that operates as a Merger & Acquisitions agent in which it collaborates with investment banking and legal experts and seeks transactions in which it can white label cutting edge technology as well as co-invest together with major buyout clients as:Private Equity Funds, Institutional Investment Managers, Family Offices, Foundations and Holding Companies.• One of the flagship transactions conducted was the establishment of Capital Foundation, a Private, for-Profit Foundation established to conduct socially responsible investments with a focus on joint ventures with captive insurance companies.• Apex buys its equity position in companies and projects via making a cash and/or cash equivalent payments as: (1) Payment made in cash equivalent financial instruments (ex: payment in shares it issues and/or owns) (2) Payment made in cash equivalent products and/or services (ex: providing marketing services at an attractive price point by adding income received from owning a large online footprint by being an online publisher).

A Few of the Advisory Law Firms we prefer to collaborate with:

• K&L Gates

• Caspi & Co

Recommendations from

Multinational Corporations :• Keter.com ( 2.5 Billion USD Conglomerate )• Teva Pharmaceuticals (NYSE Symbol: "TEVA")• Egged.co.il - the largest transit bus company in Israel operating also in Poland and Netherlands.

Our Main Investment Criteria

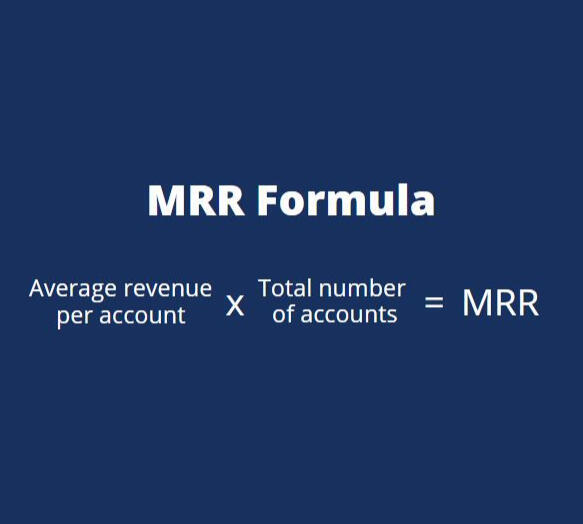

Monthly Recurring Revenue

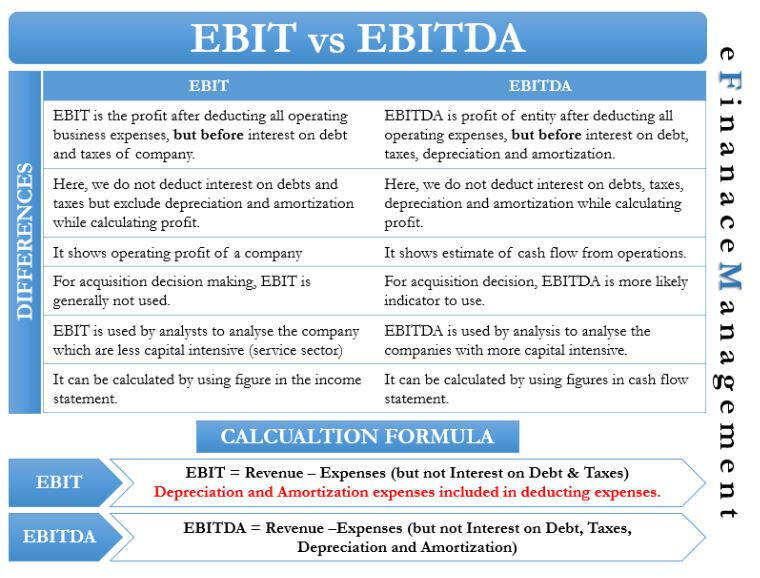

Positive EBITDA

Preference to entities with unencumbered assets

KEY TAKEAWAYS

• Unencumbered refers to assets or property without encumbrances, interests by other parties.

• Creditors have no interest in unencumbered assets as they are free and clear of debts and liens.

• Unencumbered assets are often easier to transfer than encumbered assets because only the seller and buyer must approve the transaction.

•In bankruptcy, the value of liquidated unencumbered assets is distributed to creditors.

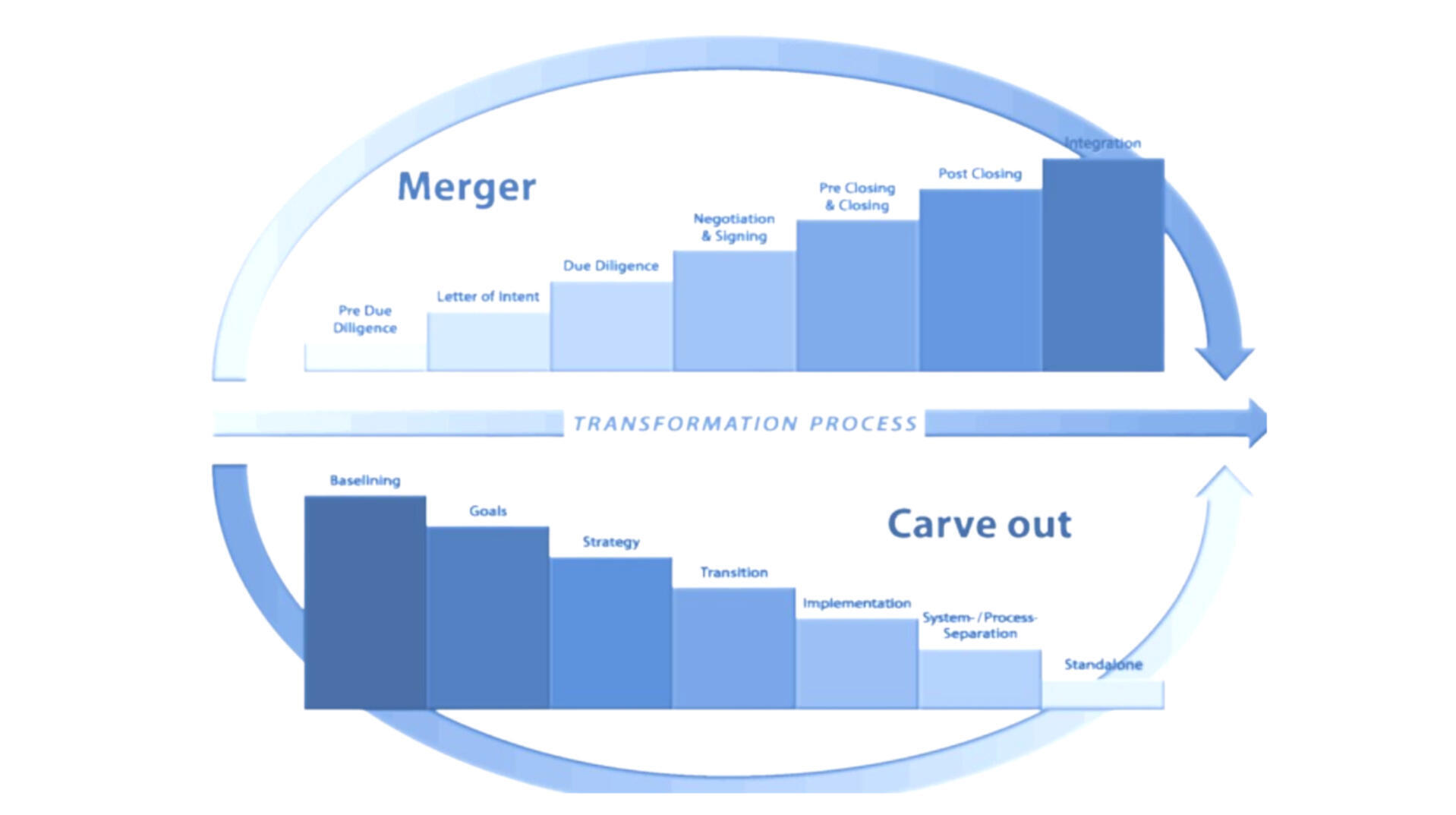

Spin-Offs or Carve-Outs are Preferred

KEY TAKEAWAYSIn an equity carve-out, a business sells shares in a business unit. The ultimate goal of the company may be to fully divest its interests, but this may not be for several years. The equity carve-out allows the company to receive cash for the shares it sells now. This type of carve-out may be used if the company does not believe that a single buyer for the entire business is available, or if the company wants to maintain some control over the business unit.Another divestment option is the spin-off. In this strategy, the company divests a business unit by making that unit its own standalone company. Rather than selling shares in the business unit publicly, current investors are given shares in the new company. The business unit spun off is now an independent company with its own shareholders, and the shareholders now hold shares in two companies. The parent company does not usually receive any cash benefit, and may still own an equity stake in the new company. To be tax-free for the final ownership structure, the parent company must relinquish 80% of control or more

Due diligence includes examining existing financials as well as conducting a soft launch of a joint service, a few examples:

• Increasing client’s sales via adding a rewards club providing ATTRACTIVE rewards.

• Improving tax efficiency as: applying for ERC tax refunds, increasing long term income revenue classified and taxed at a lower rate compared to ordinary income.

Possible Buyout Structures:

• Lump sum and/or Installments payments in cash and/or stock options of both acquired company and/or S&P 500 (symbol: SPY)

• With/Without buyout insurance against seller’s legal liabilities to clients, employees and regulators

• With/Without upside capped/uncapped bonus to seller after X time post sale

Let's Talk

Bring us your biggest challenges. We’ll build custom solutions.

_

Office : TD Canada Trust Tower, 161 Bay St. Toronto, ON M5J 1C4, Canada

e-Mail: [email protected]

Website: www.ApexBuyout.com

©ApexBuyout.com . All rights reserved.